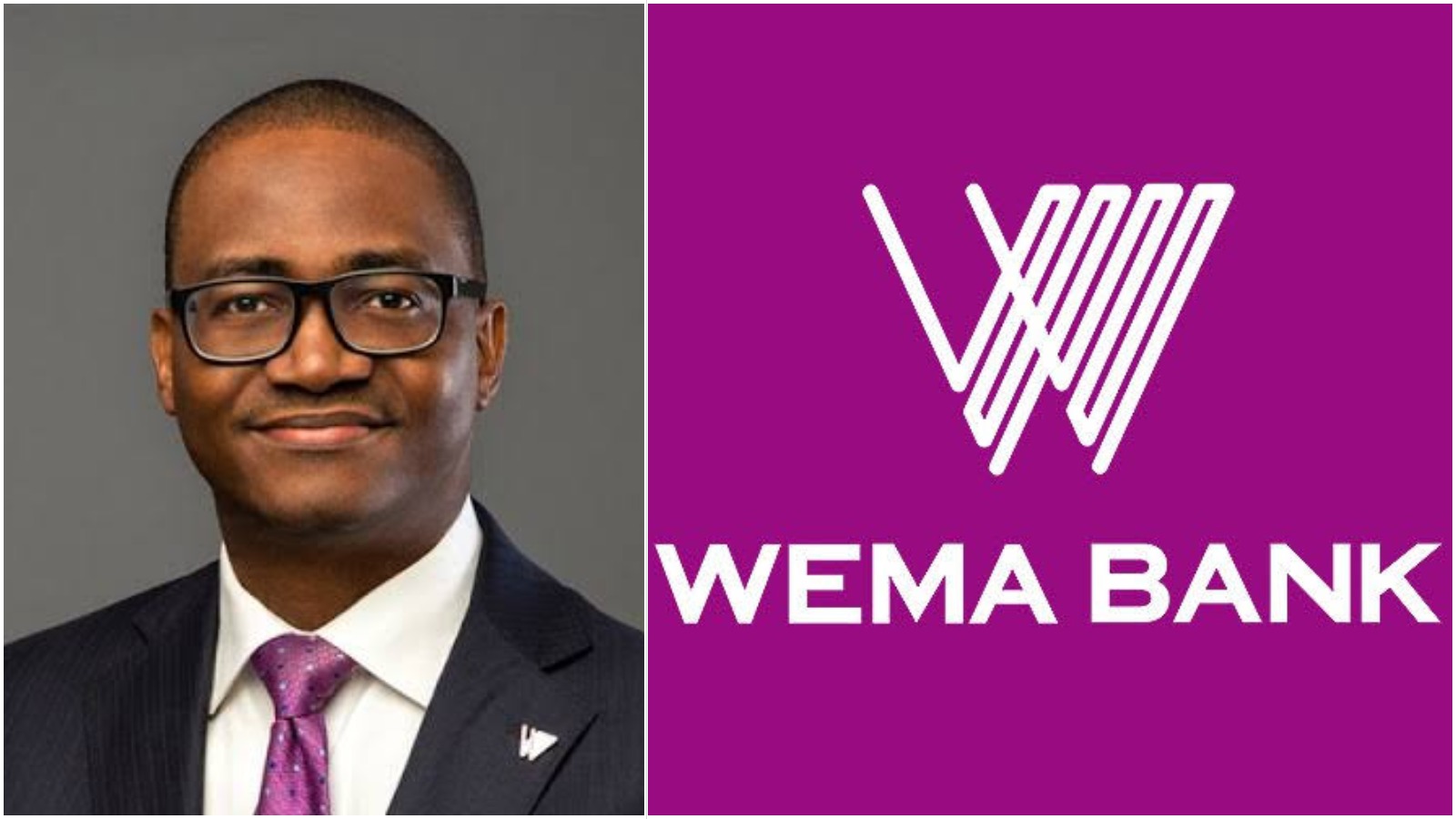

NIGERIA– Barely six months into the year, there are already a series of fraud allegations against Wema Bank, its Managing Director and Chief Executive Officer, Ademola Adebise, as well as involving other top executives at the firm.

Adebise became the Managing Director of Wema Bank in 2018, and under him, reports of illegal banking practices have been emanating from the financial institution, some of which have led to court cases, while the firm tries to sweep another under the guise of celebration.

One of the fraud cases linked to Adebise is a forgery of High Court processes and statement of Account of Bayelsa State Government, an allegation which the Magistrate court in Abuja, summoned him on May 27, 2022, to answer for.

The accusation was made by Barrister George Halliday, relating to a N50 million bounced draft issued by Adebise, and in a bid to get the court set aside the complaints lawsuit and court orders, he allegedly used forged documents to defend against the allegation.

Adebise has about 30 years banking experience, but his four years leading Wema Bank has been trailed with fraud activities in recent times, including the bank account fraud, which saw Wema Bank fraudulently open accounts for unsuspecting Nigerians.

While the bank claimed it was opening one million accounts in 24 hours, in celebration of its digital platform, ALAT, clocking five years, it was, however, fraudulently using the private information of Nigerians to open accounts without their approval, against the regulations of Central Bank of Nigeria and the National Information Technology Development Agency (NITDA).

The penalty of such crime by Wema Bank, under Adebise, relating to bank account fraud perpetrated by a financial institution is around $185 million in the U.S, according to the fine melted out against American bank, Wells Fargo, which also opened 1.5 million unapproved accounts.

But that is not where Adebise’s fraud allegation crumbs end if his steps are traced back to 2019, when Wema Bank accounts were used to move N16.4 billion within six months by Ocean Trust, a company accused of being a tool to siphon money from Alpha Beta, a tax company. The accusation was made by the former Managing Director of Alpha Beta, Dayo Apara, in a court case.

According to bank records, two Wema Bank accounts; 0702892574 and 0122613238, were used to move the money, PG, had reported, with the transactions, which occurred between January to June 2019, labeled as “Closure proceeds”.

With the head of a bank enmeshed in series of allegations, it isn’t shocking when his subordinates, who are also top executives of Wema Bank, are tied to fraud activities as well.

Wema Bank’s Head of Oil and Gas, Kingsley Ananwude, Executive Director, Wole Akinleye, as well as Head of Cooperate Banking, Emmanuel Edah have been accused of trying to bribe the Police officers to cover up the N1.7 billion illegally moved to the lender’s account number, 0122367964.

The account, owned by a pastor of the Redeemed Christian Church of God (RCCG), Isaac Adewole, was said to have been involved in multiple fraudulent transactions, according to report signed by the Commander of Area G, Lagos, ACP Ibrahim Zungura.

In a bid to launder the money, the top executives at Wema Bank had used the names of Dana Air and Caverton helicopters to clean the funds, but the airline operators denied having any dealings with Adewole in such amounts.

Despite being entangled in the fraud case, Ananwude, Akinleye, and Edah are still occupying their various positions, while Adebise, under whose watch, these alleged fraudulent activities are being perpetrated, is still leading Wema Bank.

This calls into question, the company’s corporate governance, which seems to be weak in preventing executives at the organisation from using their position in Wema Bank to carry out their illegal banking practices.

With the unethical behavior spreading in Wema Bank, more employees might join in the illegal banking practices, considering no top executive has been held responsible for their actions and inaction.