Advancement in technology across the globe, with the establishment of digital currency, is any currency, money, or money-like asset that is primarily managed, stored, or exchanged on digital computer systems, especially over the internet.

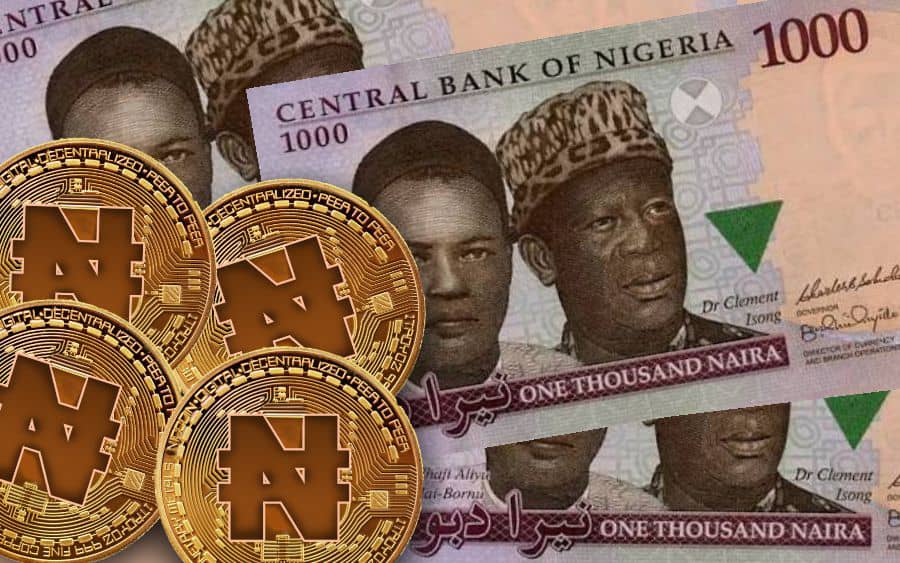

However, we have various types of digital currencies which include cryptocurrency, virtual currency, and central bank digital currency.

Digital currencies exhibit properties similar to traditional currencies, but generally do not have a physical form, unlike currencies with printed banknotes or minted coins. This lack of physical properties allows instant transactions over the internet and removes the cost associated with distributing notes and coins.

Virtual currencies are not considered a legal tender and they enable ownership transfer across governmental borders this type of currency may be used to buy physical goods and services, but may also be restricted to certain communities.

Digital money can either be centralized, where there is a central point of control over the money supply (for instance, a bank), or decentralized, where the control over the money supply is predetermined or agreed upon democratically.

Payments are also undergoing rapid change as innovative tools are emerging. Before digital currency, cash was more or less the only way to make an immediate purchase.

Today, however, we have grown accustomed to using forms of private digital money such as online bank transfers, payment cards, and applications on our smartphones or watches. These are changes that directly affect the role of central banks. The evolution of new technologies, financial innovations, and the dramatic evolution of digital currencies is transforming the way we use money, we can as well guess where digital currency will take us in the next few years.

Many countries now share an established model of providing money to the economy through a two-tiered structure, which consists of a central bank and commercial banks. The future of the monetary system will necessarily be shaped by both public and private initiatives and issuing private-based and two-layered digital currencies denominated by sovereign currency units can be a promising option.

Over the past century, almost all nation-states, including developed, emerging, and developing nations, have given their own central banks the exclusive responsibility of issuing sovereign currencies, which has led to a two-tiered monetary system, consisting of the central bank and commercial banks a system that has proved effective in enhancing the efficiency of transactions and economic development.