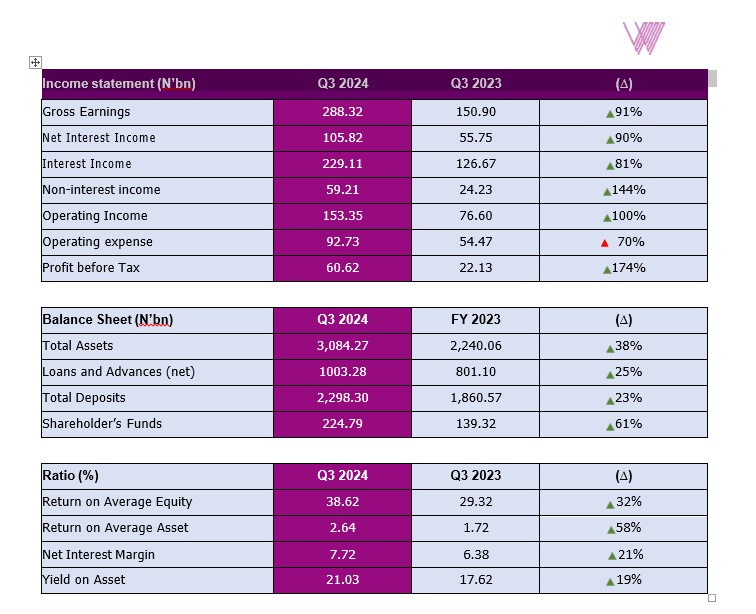

Wema Bank Nigeria has released its unaudited Consolidated Financial Statements for the period ended September 30th 2024, to the Nigeria Exchange Group (NGX).

The Bank reported profit before tax of ₦60.62bn, representing an increase of 174% over the ₦22.13bn recorded in the corresponding period in 2023.

Wema Bank’s balance sheet remained well structured with total assets growing by 38% to ₦3,084.27 trillion in Q3 2024 from ₦2,240.06trillion in FY 2023. The bank also grew its deposit base year to date by 23% to ₦2,292.30bn from ₦1,860.57bn reported in FY 2023. Loans and Advances grew by 25% to ₦1003.28bn in Q3 2024 from ₦801.10bn in FY, 2023. NPL stood at 3.19% as at Q3 2024.

The bank recorded an improved 3rd quarter performance as Gross Earnings grew by 91% to

₦288.32bn (Q3 2023: ₦150.90bn)). Interest Income was up 81% y/y to ₦229.11bn (Q3 2023:

₦126.67bn). Non-Interest Income up 144% y/y to ₦59.21bn (Q3 2023: ₦24.23bn).

Return on Equity (ROAE) of 38.62%, Pre-Tax Return on Assets (ROAA) of 2.64%, Capital Adequacy Ratio (CAR) of 14.06% and Cost to Income ratio of 60.47%, speak to the resilience of the brand.

The Managing Director/Chief Executive Officer of the bank, Mr. Moruf Oseni said, ‘our Q3 2024 numbers speaks to our resilience despite a tough operating environment. We will sustain our growth trajectory into 2025. The performance is headlined by impressive improvements in Profit before Tax which grew strongly by 174%. The growth of Gross Earnings by 91.07%, Total Assets by 38% and earnings per share at 328.1kobo shows the core improvements to our balance sheet. In addition, our cost to income ratio at 60.48% has witnessed significant improvement from the previous period.